Simply remember that eligibility necessities are strict, and it’s wise to consult with a tax skilled to substantiate that your activities meet IRS guidelines for credit score. Once registered, companies can schedule and monitor funds, which makes it easier to stay on top of quarterly obligations. It’s a handy possibility for businesses wanting a streamlined strategy to taxes.

See the Common Directions for Varieties W-2 and W-3 for info on the means to report the uncollected employee share of social safety and Medicare taxes on suggestions and group-term life insurance on Kind W-2. Enter tax quantities on traces 7–9 that result from present quarter adjustments. Use a minus sign (if possible) to point out an adjustment that decreases the whole taxes shown on line 6 as an alternative of parentheses. Doing so enhances the accuracy of our scanning software program.

File

Returns by way of mail should be addressed accurately, have enough postage and be postmarked by the united states Postal Service to one of these listed addresses (varies based mostly on state). Employers should all the time use probably the most current model of Form 941 when filing. Using an outdated model can outcome in processing delays and potential penalties.

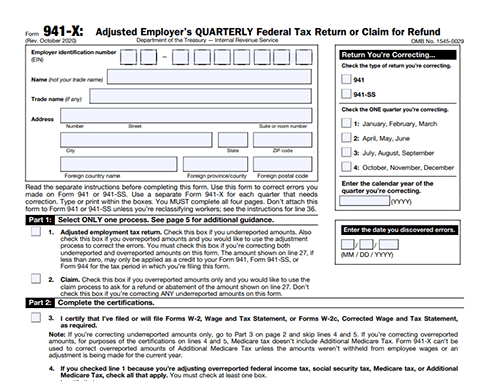

The Medicare tax price is 1.45% for both employer and worker, with an additional 0.9% withheld from workers incomes more than $200,000. If you uncover any errors, you will need to submit an amended Kind 941. You can fill out Type 941-X to correct compensation, earnings taxes withheld, taxable Social Safety tips and wages, and taxable Medicare tips and wages. Your last choice for filing Form 941 and any excellent funds or deposits is to work with an accountant or other tax skilled who can file each the form and cost for you. Usually, this is carried out via the Digital Funds Withdrawal (EFW) system we talked about above. If your business stopped paying or didn’t pay wages or different taxable compensation through the quarter, use Part three to tell the IRS.

If something doesn’t add up, you will doubtless hear from the IRS. Typically, any person or business that pays wages to an worker has to file a Form 941 every quarter and needs to proceed to take action even if there are no staff during a number of the quarters. Exceptions to this filing requirement are for seasonal employers who don’t pay worker wages throughout a number of quarters, employers of household employees and employers of agricultural staff.

- A. Yes, the IRS allows you to e-file Form 941 through its authorized e-file suppliers or payroll software, which streamlines the method and helps avoid errors.

- Rose Co. elected to take the certified small enterprise payroll tax credit score for growing analysis actions on Form 6765.

- Seamlessly automate payroll, tax filings, and native labor regulation compliance in 180+ countries.

- Whether Or Not you depend on a tax professional or handle your individual taxes, the IRS offers you convenient and secure programs to make submitting and paying easier.

- Nonetheless, this does not apply to seasonal employers or employers filing their ultimate return.

Gather The Required Info

Deposit the tax inside the time interval required beneath your deposit schedule to avoid any possible deposit penalty. The tax is treated as accrued by the employer on the “Date of Notice and Demand” as printed on the Part 3121(q) Notice and Demand. The employer should include this amount on the appropriate line of the document of federal tax legal responsibility (Part 2 of Kind 941 for a month-to-month schedule depositor or Schedule B (Form 941) for a semiweekly schedule depositor).

What Is Type 941 And When Should Or Not It’s Filed?

Embody all tips your workers reported during the quarter, even should you had been unable to withhold the worker tax of 1.45%. Penalties and interest are charged on taxes paid late and returns filed late at a rate set by legislation. You should deposit all depository taxes electronically by EFT. For more information, see Federal tax deposits should be made by electronic funds switch (EFT) underneath Reminders, earlier.

Each business with staff must file this form to report their FUTA (Federal Unemployment Tax Act) obligations. This tax funds unemployment compensation packages https://www.intuit-payroll.org/ that provide financial help to staff who have misplaced their jobs. Half Two, which begins midway on the second page, explains the tax deposit schedule for employment taxes. The deposit schedule for most employers is either month-to-month or semiweekly. If depositing monthly, a breakdown of tax liability by month is entered right here.

Getting them incorrect could imply dealing with IRS penalties or missing important deadlines. IRS Type 941, also identified as the Employer’s Quarterly Federal Tax Return, is used when businesses report the revenue taxes, payroll taxes, Social Safety taxes, and Medicare taxes withheld from their employees’ wages. Enter amounts on line 2 that might even be included in box 1 of your staff’ Forms W-2. See Field 1—Wages, suggestions, different compensation in the General Instructions for Forms W-2 and W-3 for details.

Managing payroll taxes could appear difficult, however with the right knowledge and tools, filing Type 941 turns into easy. By understanding its function, following a step-by-step process, and using payroll software program, you presumably can ensure compliance whereas saving effort and time. Operating a enterprise means juggling many obligations, from managing day-to-day operations to ensuring compliance with tax legal guidelines. Staying on high of payroll taxes is important to maintaining financial health and assembly your obligations as an employer.

File your preliminary Kind 941 for the quarter in which you first paid wages which are topic to social security and Medicare taxes or subject to federal revenue tax withholding. IRS Kind 941, Employer’s Quarterly Federal Tax Return, is the federal tax type employers use to report revenue taxes, Social Safety tax, and Medicare tax withheld from employees’ paychecks. Employers also use this type to pay their portion of Social Safety and Medicare taxes. Employers who file 10 or more information returns, Kind 1099 collection, Type 1042-S, and Kind W-2, are required to file them electronically. Employers are to combine virtually all info return types to find out whether or not a filer meets the 10-return threshold, this includes Types W-2, filed with the Social Safety Administration.