Additionally, refinancing frees up homeowners’ finances to engage in different forms of spending, which might profit the economic system. The CFPB will proceed to monitor and report on refinancing activity and business practices that encourage or discourage borrowers seeking to refinance. The CFPB is also exploring methods to streamline the refinancing course of and reduce closing prices. Interest charges have declined from their peak, offering some respite to potential homeowners, but housing affordability is still a challenge. Today, the typical household must spend about 36% of their month-to-month earnings to afford the monthly mortgage fee for the median home.

The Basics Of Amortized Loans

From the attitude of lenders, rising rates can result in elevated revenue from curiosity, but also carry the danger of higher default rates as borrowers struggle with bigger payments. Amortization is a crucial facet of the mortgage course of that each home-owner should understand. It refers again to the strategy of paying off a loan over a time frame via regular payments.

Understanding this dynamic helps you make knowledgeable choices about your mortgage and reimbursement technique. For instance, making extra principal payments, especially early on, can significantly shorten your mortgage time period and reduce the entire curiosity paid. Understanding the impression of interest rates on month-to-month payments is essential for both borrowers and lenders. It influences monetary choices, mortgage terms, and the general value of borrowing. By rigorously contemplating rates of interest and their effects, people can better handle their debts and work towards their monetary targets. When it involves variable price mortgages, one of the most essential ideas you need to perceive is amortization.

In the panorama of economic strategies, refinancing stands out as a potent maneuver for individuals grappling with the burden of excessive rates of interest. This strategy includes the restructuring of existing debt obligations, typically by securing a brand new loan with extra favorable terms. It’s a tactical transfer that may present respiratory room in a finances, permitting for funds to be redirected in direction of other financial targets or requirements.

“No denial payday loans direct lenders only” might sound like the perfect solution, but there’s more to this story than meets the attention. Dive in and uncover the truth about these quick cash loans, the potential risks, and the means to navigate them responsibly. A variable-rate loan (also known as an adjustable-rate loan) features an rate of interest that may change periodically, based on market circumstances or a benchmark price just like the prime fee or LIBOR. Business homeowners who make further funds and clear loans sooner, find yourself saving cash in the long term. However that is easier stated than carried out, especially for small and medium companies that wrestle to take care of constant cash circulate.

Able To Advance Your Monetary Goals?

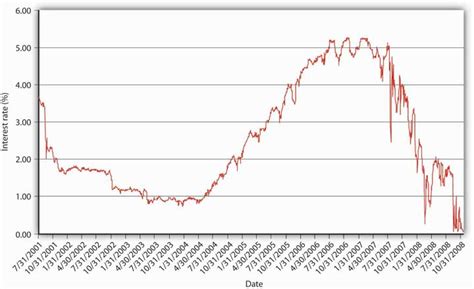

If the rate of interest have been to lower to 3%, the month-to-month payment would lower to $421. When rates of interest are high, the month-to-month payments on an amortized loan are also excessive. For example, if a borrower takes out a $100,000 mortgage for 30 years at an interest rate of 5%, the month-to-month cost would be $537. If the interest rate have been to extend to 6%, the month-to-month fee would improve to $599. During the early years of the Covid-19 pandemic, rates of interest fell to historic lows and hundreds of thousands of consumers bought properties or refinanced to decrease rates of interest. Home prices have been rising sooner than incomes, however the low interest rates made mortgage funds more reasonably priced, a minimum of on a national degree.

Beyond Mortgages: Amortization In Other Loan Varieties

- This clarity is invaluable for budgeting and long-term financial planning, permitting you to see the direct influence of additional payments.

- The next time you evaluate a loan statement or contemplate borrowing cash, bear in mind the facility of understanding your amortization schedule.

- Nevertheless, a large last fee, often identified as the “balloon” fee, is due on the end of the time period.

- There are three main components that drive rates of interest, inflation, fiscal insurance policies, and consumer spending.

The interest rate on your mortgage may have a big effect on your general prices, regardless of the amortization interval. If you perceive interest rates, you’re in a better place to negotiate with lenders. For instance, when you have an excellent credit score rating, you probably can negotiate a lower rate of interest with the lender. Moreover, you have to use your understanding of interest rates to ask the lender questions in regards to the mortgage terms and situations. Curiosity charges rose quickly in 2021, rising 4 percentage points in less than a yr.

Because of these uncertainties, variable fee loans can be extra suitable for borrowers with an ability to soak up greater payments if needed. Curiosity charges play a critically essential function when it comes to amortization schedules, which are the break-down of payments required to repay a loan over a given period of time. Interest is factored into every fee, usually calculated as a percentage of the whole mortgage balance.

Even small further payments utilized on to principal can dramatically cut back each your mortgage term and total interest paid. Closing prices, potential prepayment penalties, and the length of time a borrower plans to stay in their house are all crucial concerns. It’s a call that must be made with a complete understanding of 1’s monetary situation and the present financial climate. Finally, when used judiciously, refinancing is a powerful device to fight high interest rates and might significantly impact one’s financial trajectory. In abstract, interest rates play a vital position in determining how much a borrower can pay each month, as well as over the entire lifetime of the mortgage.

From the perspective of a home-owner with a mortgage, the first technique might be to lock in a fixed-rate mortgage, which offers safety against rising charges. However, if interest rates are anticipated to decline, an adjustable-rate mortgage (ARM) could be extra advantageous, permitting the borrower to benefit from decrease payments. This means that the borrower pays a set amount of interest https://www.simple-accounting.org/ each month, no matter how a lot of the loan has been paid off. Compound interest, on the opposite hand, is calculated primarily based on the principal quantity plus any accrued curiosity.